Yes, eligible electric vehicles are now 100% tax-free under Australia’s new fringe benefits tax (FBT) exemption. If you’re salary packaging an EV through a novated lease and it’s below the luxury car tax threshold, you won’t pay any FBT, GST, or income tax on the lease or running costs.

With this new tax-free EV legislation, the Australian government is trying to increase the take-up rate of electric vehicles by making them more affordable. To do this the Government is changing the Tax Act to make EVs under $84,916, 100% FBT exempt.

Try our EV Novated Lease calculator to see how this makes EV’s so affordable, or to see the full range of EV’s and PHEV’s available in Australia click HERE.

To quickly see how much you can save on an eligible electric vehicle with a novated lease, try our novated lease calculator. It’s a fast and easy tool to help you understand how the new tax legislation can make EV ownership more affordable.

What Is the Tax-Free EV Legislation?

The Federal Government’s EV incentive, passed in late 2022, is designed to boost the adoption of electric cars by making EVs more financially accessible. The legislation removes fringe benefits tax (FBT) from salary-packaged electric vehicles and plug-in hybrid electric vehicles (PHEVs) under the luxury car tax threshold for fuel-efficient vehicles, currently $91,387 (2024–25 financial year)

This means:

- If you lease a qualifying EV through your employer, it’s 100% FBT exempt.

- You’ll also skip the 10% GST on electric vehicles and all associated running costs, including charging and servicing.

- Plus, you can pay for everything using your pre-tax salary, reducing your taxable income.

How the Novated Lease Works Under the New Rules

A novated lease is a three-way agreement between you, your employer, and a finance provider. You lease the car, and your employer helps cover the repayments through salary packaging.

Here’s where the tax-free EV rules make a real difference.

Under the new electric car tax exemption, if your EV is eligible:

- No FBT applies.

- Your lease payments, registration, insurance, servicing, tyres, and even home charging equipment can be paid pre-tax.

- No GST is paid on the purchase price or the running costs.

That’s up to 32% in savings for the average employee, combining income tax and GST exemptions.

Let’s simplify it…

Before the new law, salary-packaged cars were subject to FBT (typically 20% of the car’s value). That amount came out of your post-tax salary, reducing your savings. Now, with no FBT and no GST on electric vehicles, it’s a clean sweep on tax for eligible EVs.

When Does the FBT Exemption Apply?

The FBT exemption only applies if the EV:

- Has a first retail sale value below the fuel-efficient car luxury tax threshold (currently $91,378).

- Is a battery electric.

- Is first used on or after 1 July 2022.

- Is used by a current employee under a salary packaging arrangement (i.e. novated lease).

- Weighs less than one tonne and is designed to carry fewer than nine passengers.

Used EVs are included too, as long as their first retail use was after 1 July 2022 and the original sale price fell below the luxury car tax threshold.

What Electric Vehicles Are Eligible?

The exemption applies to many of Australia’s most popular low-emission vehicles, including:

- Kia, EV3, EV5 and the Base model EV9

- Tesla Model 3 and Model Y (base models)

- BYD Atto 3

- MG ZS EV

- Kia Niro EV

- Hyundai Kona Electric

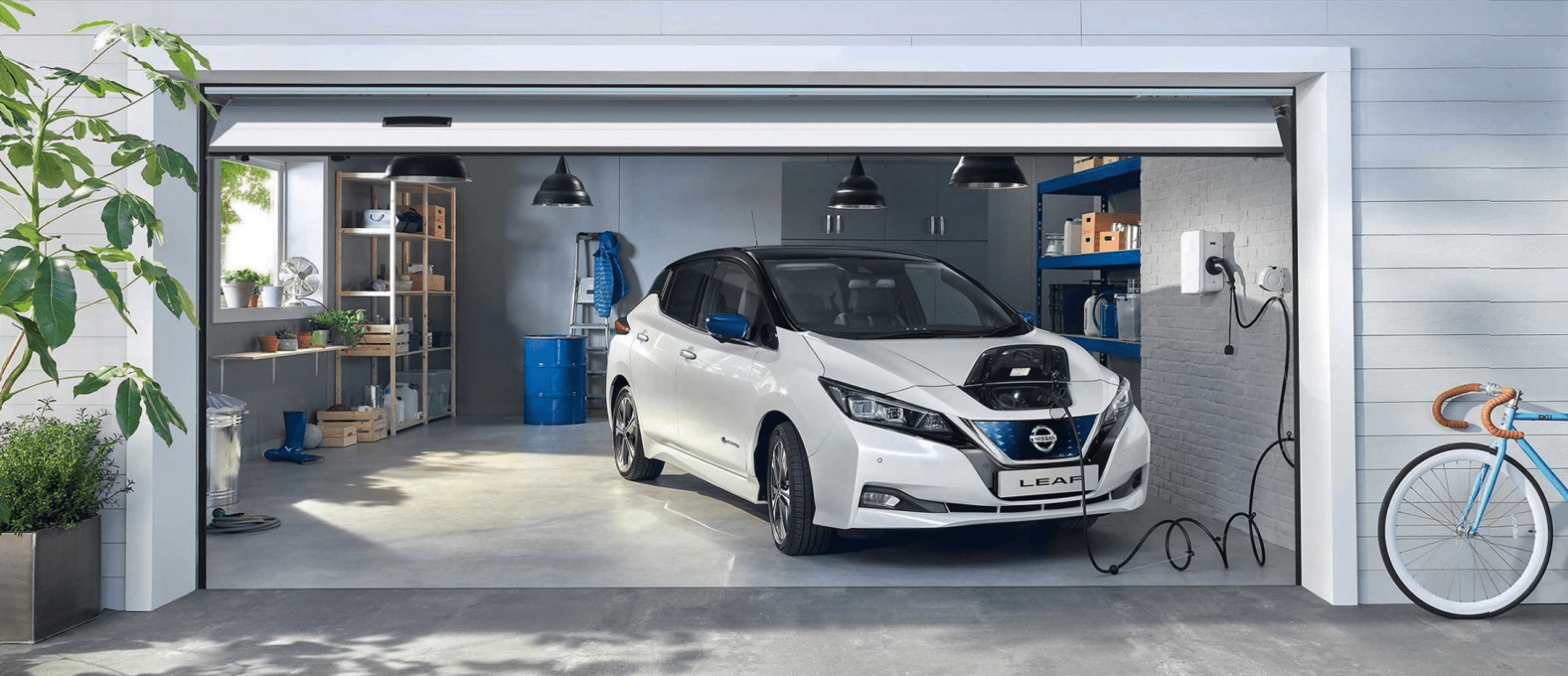

- Nissan Leaf

- Polestar 2

- Cupra Born

- Volvo XC40 Recharge

- Mazda MX-30 Electric

You can compare and calculate your novated lease costs on any FBT-free EVs directly through our EV leasing calculator.

At Vehicle Solutions Australia, we’ve been simplifying car finance for over 40 years. Based right here in Adelaide, we support over 400+ employers nationwide with transparent, competitive novated leasing options. With our partners at Motorbuys, we make it easy to compare and purchase eligible EVs, including the latest Tesla models, hybrids, and plug-in electric vehicles.

What Does This Mean for Running Costs?

All running costs associated with your EV can be included in your novated lease:

- Charging (home or public)

- Registration and CTP

- Comprehensive insurance

- Servicing and maintenance

- Tyres and roadside assistance

These costs are also GST-free and pre-tax, resulting in an even lower total cost of ownership.

To put it plainly: You’re paying for your fully electric vehicle out of income that hasn’t been taxed yet, and you’re not getting hit with any GST either. That’s the magic of the FBT exemption.

What Is a Zero or Low Emissions Vehicle?

The legislation defines a zero or low emissions vehicle as:

- A battery electric vehicle (BEV)

These vehicles produce fewer tailpipe emissions than traditional internal combustion engines and are central to Australia’s long-term climate and energy policy.

Frequently Asked Questions

What is the EV road tax in 2027?

Currently, most states and territories are reviewing how road use charges apply to electric cars. For example, Victoria proposed a usage-based charge per kilometre but paused enforcement in early 2024 pending a ruling by the High Court. Expect national changes to emerge around mid-2027 as EV ownership scales.

What is the ATO ruling on electric cars?

The ATO (Australian Taxation Office) enforces the FBT exemption and outlines the criteria for eligibility. Their ruling supports tax-free treatment of eligible EVs under novated lease arrangements, provided they meet all conditions post 1 July 2022.

Is the Australian government considering a new road use tax for electric vehicles?

Yes. As fuel excise revenue declines with more battery electric vehicles on roads, the federal government is assessing road-user charges to offset lost tax income. Any changes are likely to be gradual and consistent nationally to avoid confusion across states.

Are used electric cars eligible for the FBT exemption?

Yes, provided the car was first sold and used after 1 July 2022, and the initial sale price was below the luxury car tax threshold for fuel-efficient vehicles. It doesn’t matter if you’re not the first owner; the exemption still applies.

Is electricity GST-free when charging my EV?

No, electricity is not GST-free in Australia. However, if your EV charging is salary packaged under a novated lease, your charging costs become GST-exempt for you, because they’re paid using pre-tax dollars and claimed through your lease provider.

Ready to Drive a Tax-Free EV?

Whether you’re eyeing the latest Tesla model or a zippy little MG ZS EV, Vehicle Solutions Australia makes it simple to drive smarter and save more. With transparent leasing, zero tax surprises, and real-time calculators to show your take-home savings, switching to an electric car is now a financial no-brainer.

Still unsure? Call us on 61883384427 or reach out for a quick chat with one of our SA-based consultants.